06 Mai Dental Bookkeeping: The Ultimate Guide to Making Sense

Or It can be that a certain transaction did not download from your bank feed and that you’ll have to add it manually. In addition, they can also spot money being misused, embezzled and is a good way to find wrongly categorized income and expense transactions. A good thing to note is that you can always go and add more accounts to your chart of accounts so if you forgot something you can always add it later. The other main difference between the two is when taxes are paid. We continue to grow and advance our services to meet your needs. Our studies analysts will assist you to get custom designed info to your report, which may be changed in phrases of a particular region, utility or any statistical info.

- To achieve this goal, here are 5 tips for ensuring that your bookkeeping is accurate and up-to-date.

- To do this, you’ll just make sure the gross pay and employer payroll tax totals on the Profit & Loss matches the payroll reports.

- The report focuses on the Dental Software Management market size, segment size (mainly covering product type, application, and geography), competitor landscape, recent status, and development trends.

- In addition, they can also spot money being misused, embezzled and is a good way to find wrongly categorized income and expense transactions.

A common phrase I often hear is, “the first step is usually the hardest”. Luckily in bookkeeping, this isn’t the case because choosing an accounting software is pretty straightforward. 360 Research Reports is the credible source for gaining the market reports that will provide you with the lead your business needs. Our aim is to provide the best solution that matches the exact customer requirements. This drives us to provide you with custom or syndicated research reports. Seychelle is a Maryland-based personal finance writer and business owner.

Fees

Tax delinquencies are one of the dental practices’ most common bookkeeping issues. The key to avoiding them is staying on top of filing and paying taxes on time. Once tax payments become delinquent, penalties and interest charges may be applied, costing your practice hundreds or even thousands of dollars. Zoho Books is a cloud-based accounting solution that makes the bookkeeping process easier and more efficient. Zoho Books offers features such as automated invoicing, payment tracking, and financial reporting so that users can always get up-to-date information on their finances. Now that the 1st and 2nd step is out of the way, it’s time to actually start doing bookkeeping and at the heart of that is, characterizing your transactions for your dental practice.

Parish Administrator – Episcopal News Service – Episcopal News Service

Parish Administrator – Episcopal News Service.

Posted: Thu, 08 Jun 2023 07:00:00 GMT [source]

In addition, we’re constantly inclined to conform with the study, which triangulated together along with your very own statistics to make the marketplace studies extra complete for your perspective. Technological innovation and advancement will further optimize the performance of the product, making it more widely used in downstream applications. Moreover, Consumer behavior analysis and market dynamics (drivers, restraints, opportunities) provides crucial information for knowing the Dental Software Management market.

Sage Accounting

For example, the payroll for your receptionist would be considered an overhead expense. In contrast, the dentists’ and hygienists’ payroll would be considered to be part of the Cost of Sales. One strictly for the business, and one that’s for personal transactions. Taxes and financial statements aren’t the only areas that could be affected.

New Business Licenses: May 2023 – The Advocate-Messenger – Danville Advocate

New Business Licenses: May 2023 – The Advocate-Messenger.

Posted: Tue, 20 Jun 2023 13:46:00 GMT [source]

The dental bookkeeping firm you hire will be responsible for tracking your cash flows and expenses and possibly managing your payroll too. Therefore, hiring a trustworthy firm with a good reputation is essential. We know that each business has different and unique accounting needs and we’re well versed enough to be able to adjust our techniques to whatever you need. You probably won’t be the one to take care of keeping records and managing your accounts. You will need to hire an accountant to help you with auditing your books and preparing taxes at the very least. Otherwise, your office staff will do most of the bookkeeping for you.

We are more than your typical bookkeeping and accounting firm . . .

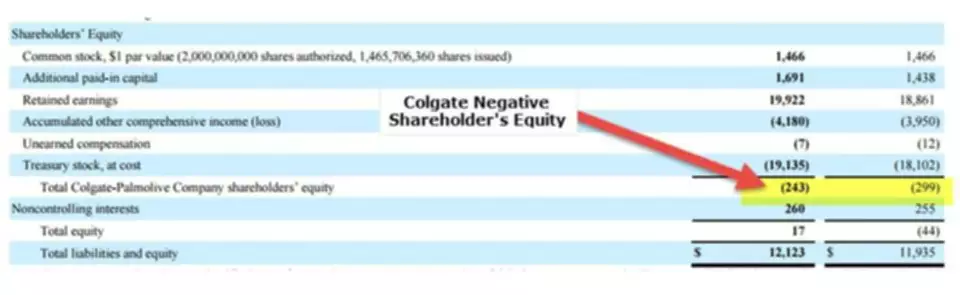

While things like accounts receivable, cash on hand, and Inventory are all categorized as assets. Under every balance sheet, the accounting principle must remain true that liabilities + owner’s equity must always equal assets. Now that you’re accounts are reconciled and your bookkeeping is up-to-date, you can easily generate Financial reports that determine exactly how well your business is doing. It’s a good practice to reconcile your accounts as often as you can, but at the bare minimum, you have to do it at least monthly. The cash method is way simpler because there are no accounts receivables and accounts payable but it doesn’t provide as much detail. The other and more common way is the accrual method, with this revenue is recorded when the invoice is sent regardless of when you receive the payment.

Bookkeeping firms may specifically disclose their familiarity with software such as QuickBooks on their websites. When you keep your books up to date, you should be able to pinpoint mistakes and establish new protocol right away before getting your practice into a situation that could take a long time to resolve. We teach you step-by-step how to calculate and compare your practice overhead percentages against the average of other practices.

Just pay your practice bills, and run your payroll. We do the rest.

Furthermore, the report provides detailed cost analysis, supply chain. This report focuses on the Dental Software Management in global market, especially in North America, Europe and Asia-Pacific, South America, Middle East and Africa. This report categorizes the market based on manufacturers, regions, type and application. Depending on what works for your business you could also choose to close books annually. Apply for financing, track your business cashflow, and more with a single lendio account.

- Keep the records they require, in the way you agree to keep them, and tax time will be much easier for you.

- I called almost in desperation one January 1st and spoke to Sona, explained my problem and soon I signed reluctantly because I had not been able to get my problem solved for many years.

- When you partner with Drill Down Solution, you gain access to the exceptional accountants and CPAs who can give you expert guidance and advice on all tax planning issues.

I’d like to share our Bookkeeping for Dentists monthly checklist with you and walk you through the items on it so you can also achieve the same quality bookkeeping. If you’re not the one doing your bookkeeping, then this would be great to share with your current bookkeeper or accountant to follow along. First, establish a new bookkeeping protocol for your practice to handle all financial transactions in an organized manner.

Implementing a new procedure will help you stay organized and up-to-date with billing, invoicing, and payments from vendors or patients. You can also use the data in these documents to create monthly financial reporting for your company. So while the earlier suggestion of adopting cloud-based dental accounting software is effective at cutting down should you really buy stocks now or wait a while longer on paper, it doesn’t eliminate the need to keep certain documents. Without the following documents stored safely in your records, you could face big problems. When making a dental accounting entry, it’s easy for all of the numbers to start running together. Before you know it, there are transposed numbers or expenses recorded in the wrong place.

Sorry, the comment form is closed at this time.